Unfortunately, our caution last week was warranted

The downtrend in the markets continued. As mentioned last week, we are looking for longer moving average supports for BTC (100 day, 200 day) and/or an increase in volume of bullish Shots called from qualified influencers before looking to take new entries. Neither of those have played out, so we remain mostly on the sidelines.

Here’s a list of indicators we are watching and the influencers that have championed them.

Indicator #1: BTC moving average for the 21 day, 100 day, and 200 day

The MA is commonly used in technical analysis to smooth out price data and help identify trends by filtering out the noise from random short-term fluctuations. Data Dash, a solid market influencer, has leaned on this indicator in recent crypto markets.

We will be looking at how BTC reacts to its 100-day moving average (MA) (currently at ~60k) to get a better sense of the wider market. If it fails there, we will be keeping an eye on the 200-day MA (currently at ~49k). Here’s how they stand at the time of writing:

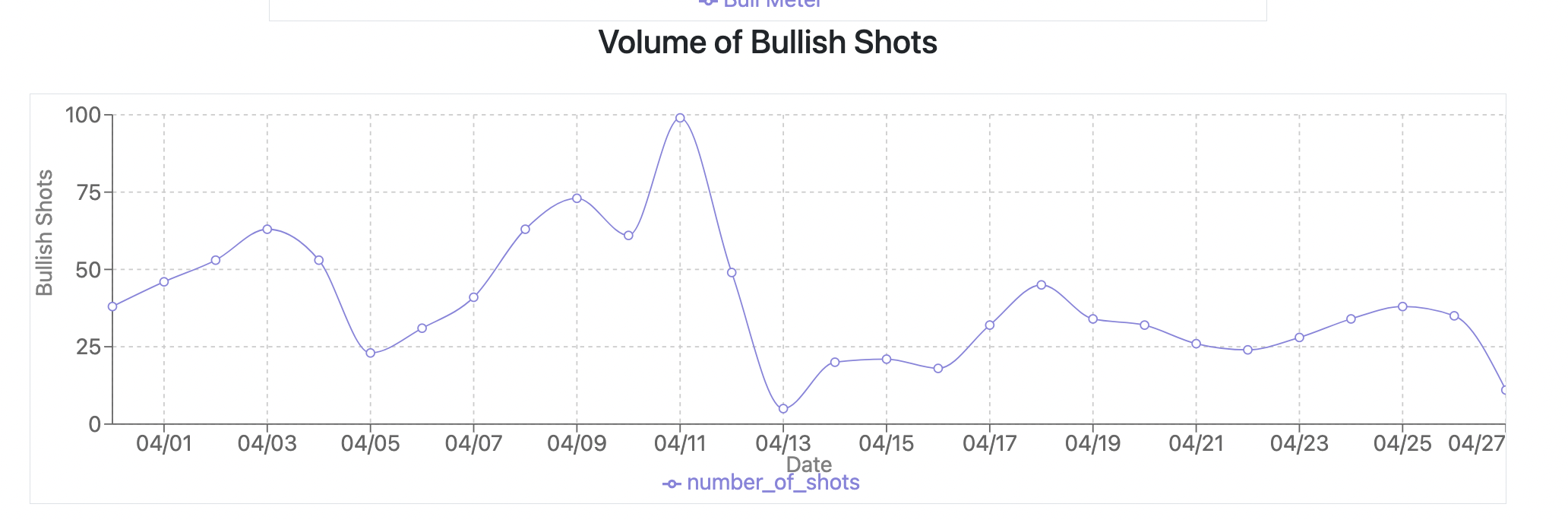

Indicator #2: the volume of bullish shots from qualified Shot Callers (proprietary data)

We can see the market has not regained its exuberance, rational or otherwise. We will be looking for an uptick in bullish posts and videos from quality Shot Callers before we look to board another rocket.

Indicator #3: Weekly stochastic RSI on BTC

The Stochastic RSI is a technical analysis indicator used to generate overbought or oversold signals. It is an oscillator that measures the level of the RSI relative to its high/low range over a set period of time. The Stochastic RSI is essentially an indicator of an indicator. It applies the Stochastic oscillator formula to values of the Relative Strength Index (RSI). The result is a value that is used to predict possible turning points in the underlying asset’s price movements.

Though we weight less what comes out of this channel, this indicator does appear to be solid for spotting macro trends. What do you think?

Looking forward to the coming week(s)

We will let the data decide where we go. The market could find support and social crypto could find its bullish sentiment at the 100-day moving average. Or we could fall to test the 200-day MAs.