Wen moon? The chatter on why we are trending down

- Gensler’s SEC sues Uniswap

- Iran and Israel trade attacks with risk of wider conflict

- Inflows into BTC ETF flatten

- Inflation remains high

- Profit taking from traders that were DCA’ing in the bear market

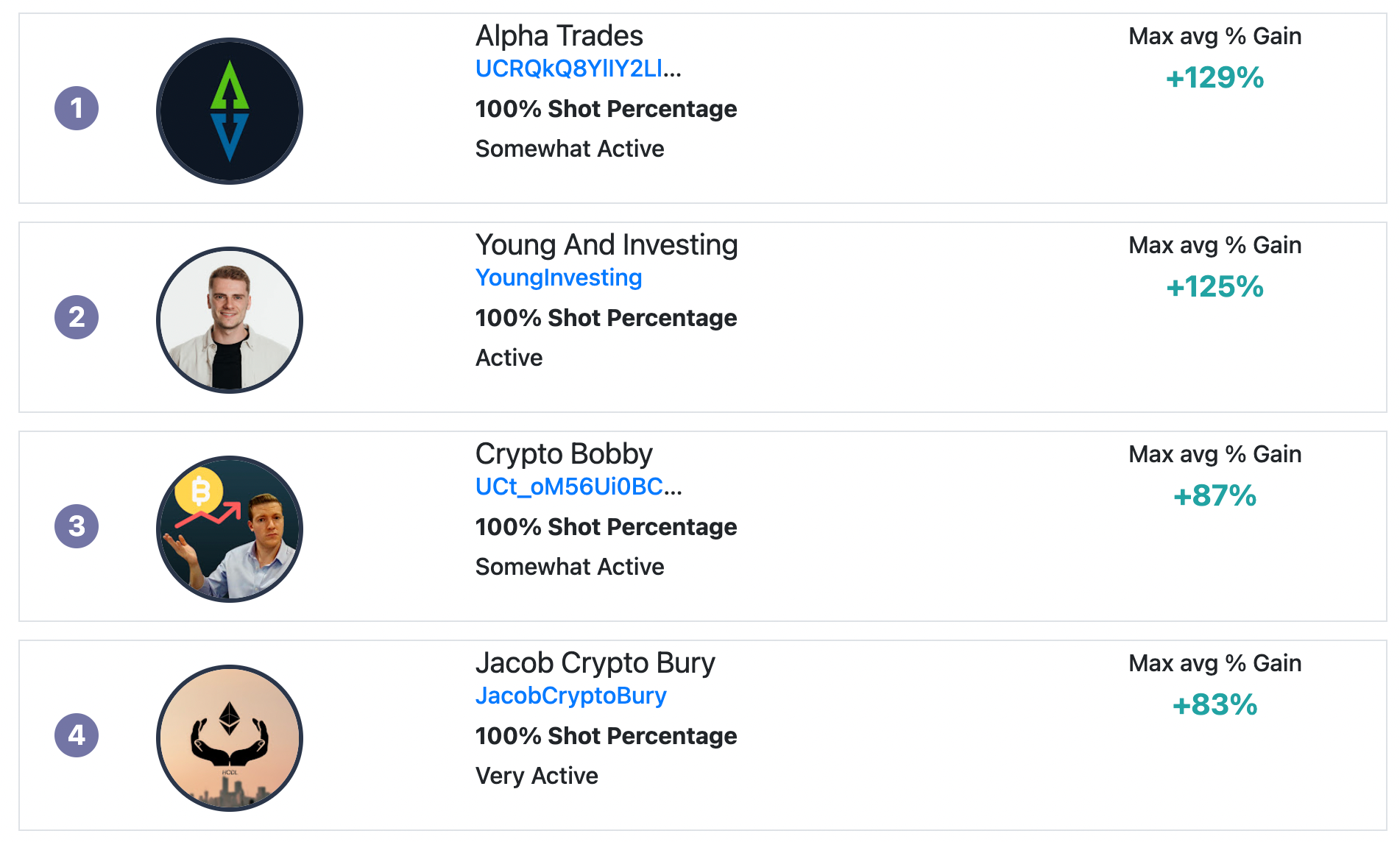

Which Shot Caller would have made you the most stacks on crypto lately?

These are some of the best financial influencers we have been tracking over the last two months. We look for influencers that have the pulse of the market by measuring ROI over 30 days. We ingest Youtube and Reddit and use AI to capture their predictions about the crypto markets.

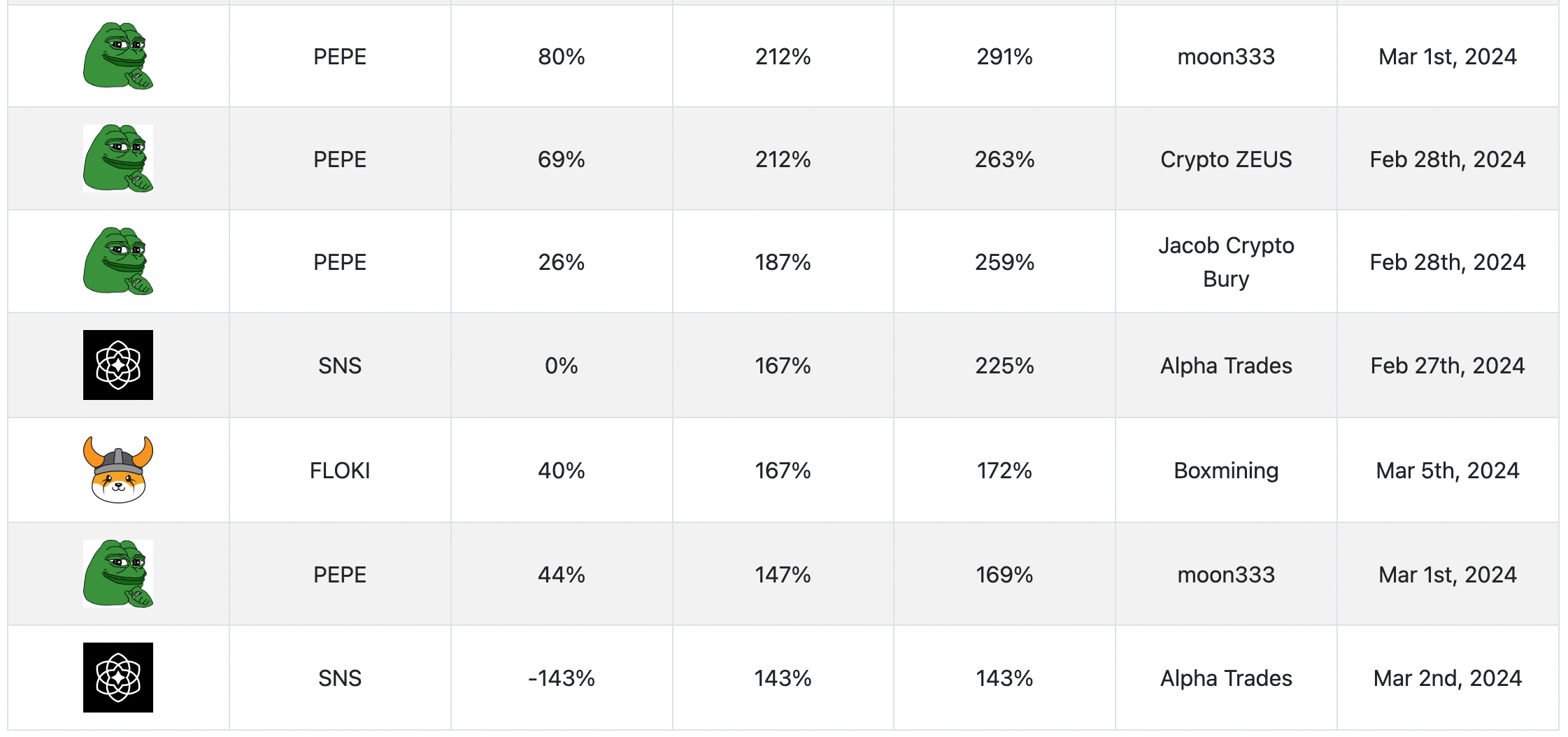

The best recent shots

The degens continue to call the shots. The YouTube influencers in our database that had a grip on the pulse of the meme market offered some of the best possible gains.

The coming week(s)

The general sentiment is mixed right now for the short term outlook. Lots of Shot Callers have entries during the bear market and are now up anywhere from 300% – 1000% (without leverage) so it is natural we are in a profit taking season.

However, there is pretty wide consensus that this bull run is not over and in the coming weeks/months it is time to look for overlooked ecosystems and narratives and good re-entries points on ones that have already pumped.

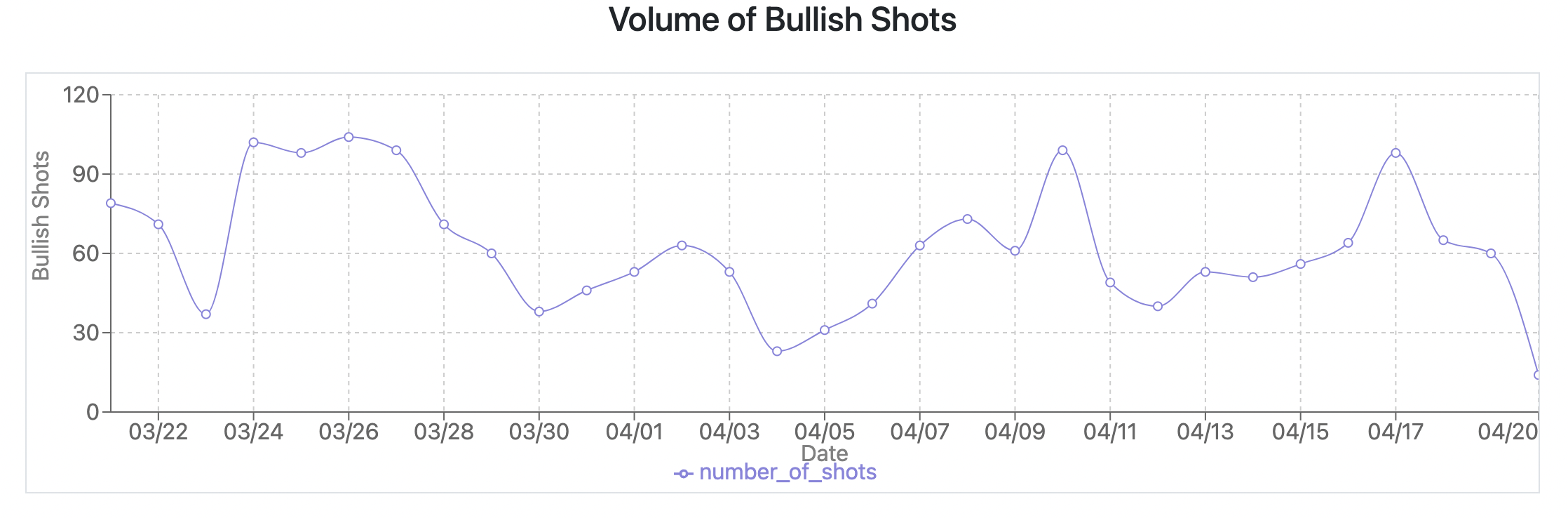

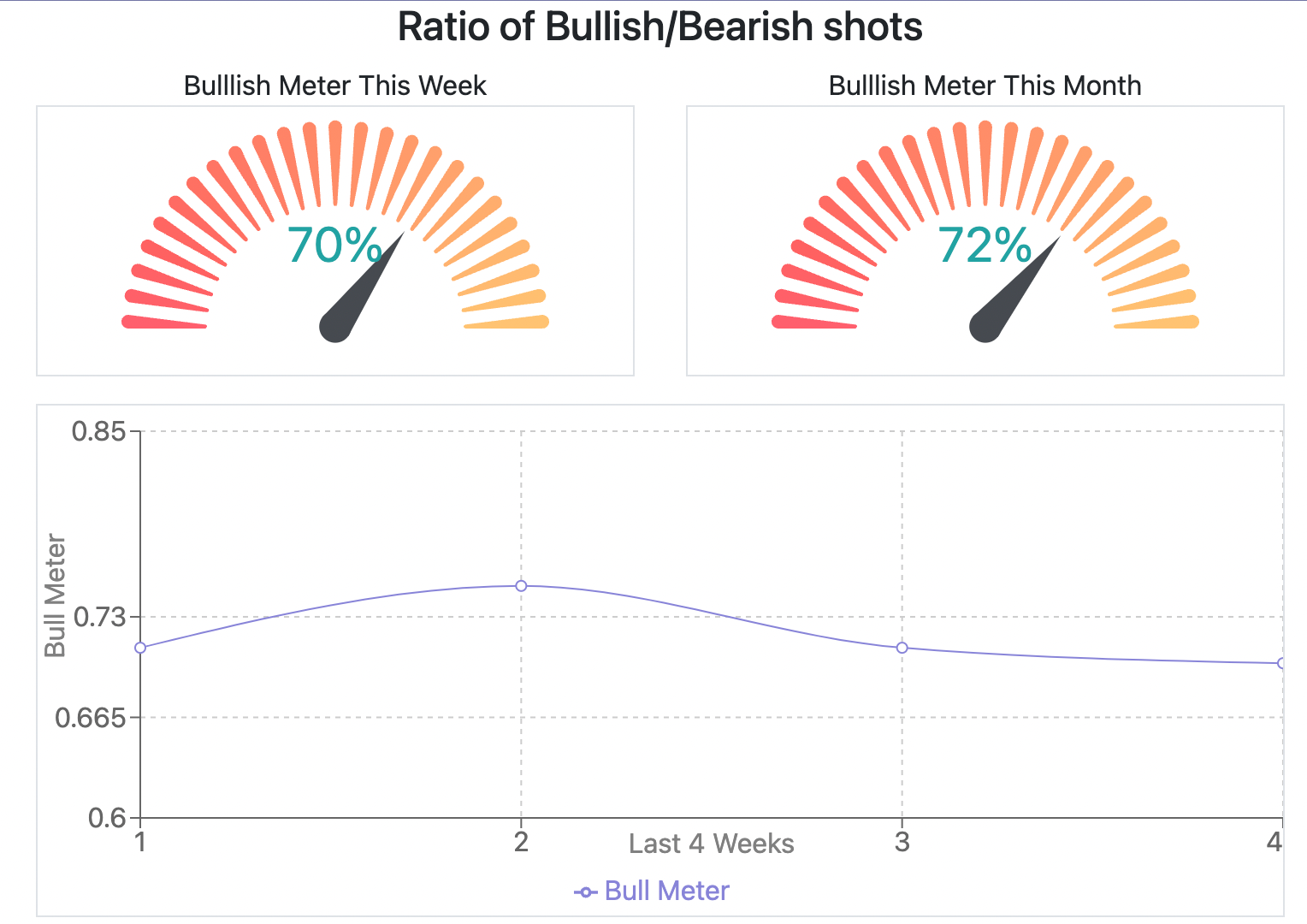

The Shot Caller meters have been trending down.

The volume of shots has been the best indicator so far in this bull market run. Influencers are reluctant to tell their followers to sell anything because they will get labeled as a FUD’r or worse. But volume seems to give us a clearer window into their true model of the market.

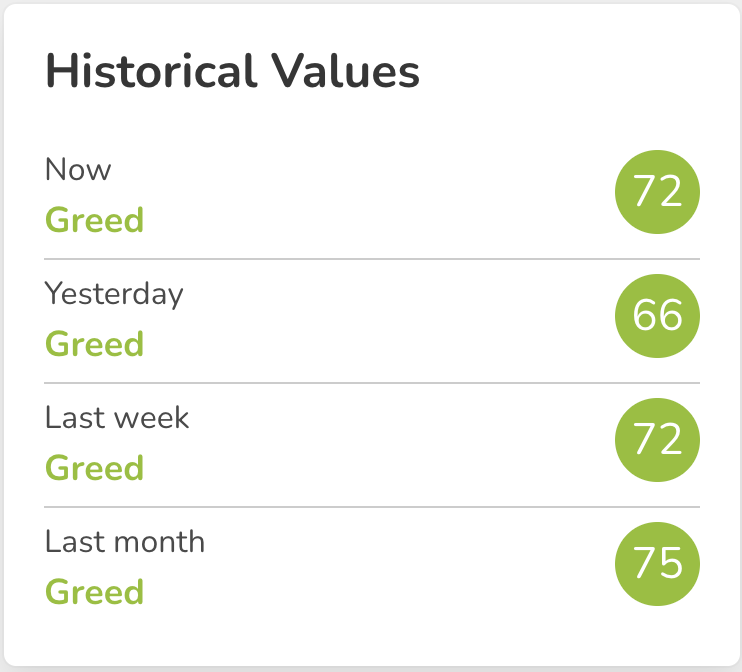

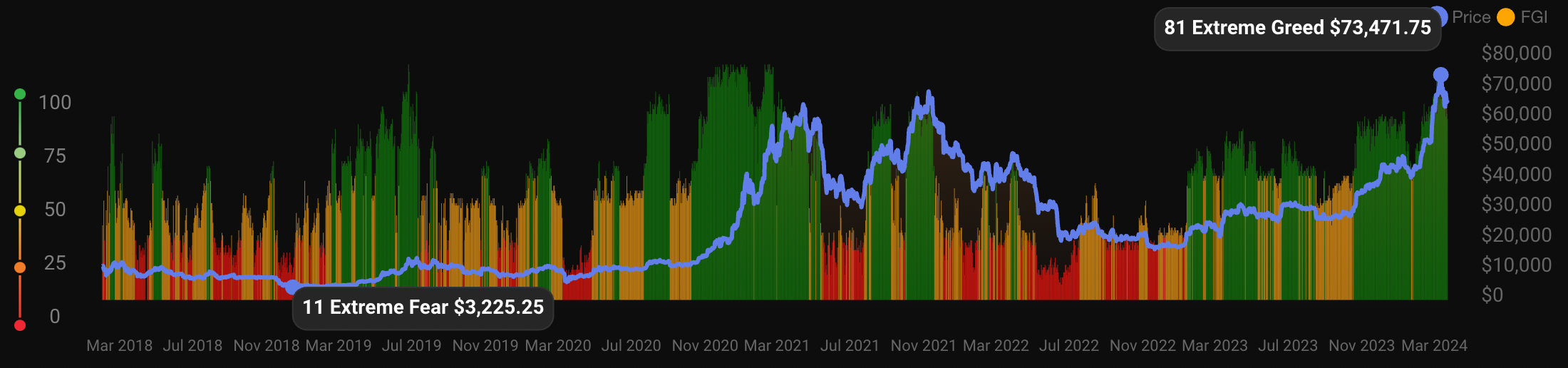

The Fear/Greed index from alternative.me is peeking back into greed levels (top). Mapping the Fear/Greed to BTC price from CoinStats(bottom)

Fresh Shots

The volume of shots is low so I would like to see that volume tick up before looking for a new entry point. Failing that, tests around 100 day moving average would also be interesting.

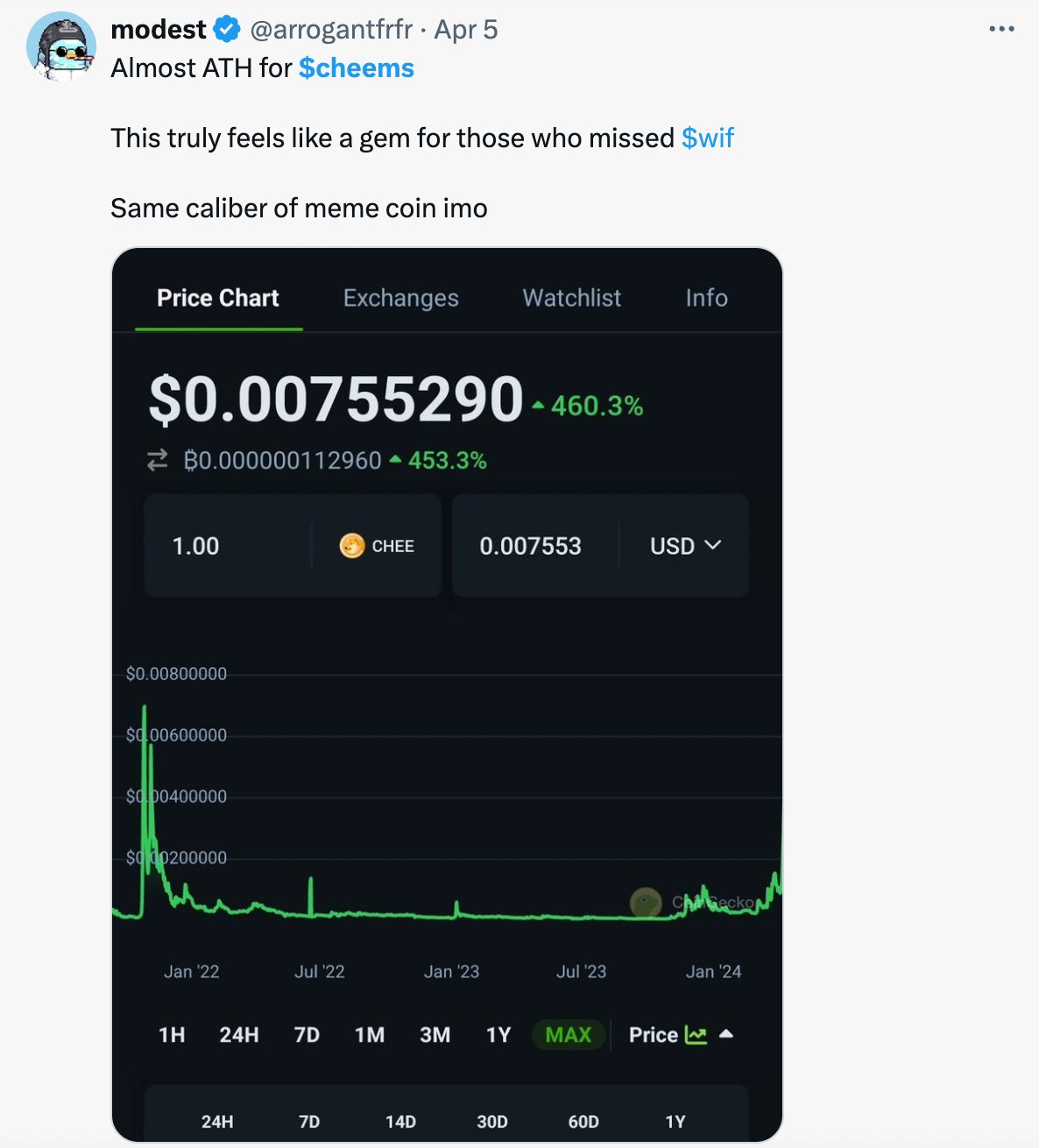

Having said that, here is some recent chatter around potential degen gems: $PUFF, $CHEEMS. These are more like degen bets so obviously not financial advice.

See you next week

We are still in BETA so send any questions, feedback, suggestions our way DM at https://twitter.com/ShotCallerAI or email me.

-Shot Caller Team