…and we’re back!

We have been tweaking our pipelines based on feedback from our earlier edition of Shot Callers. This is very much an iterative process, and in the spirit of ‘the perfect being the enemy of the good’, we will issue one newsletter a week reporting on crypto financial influencers.

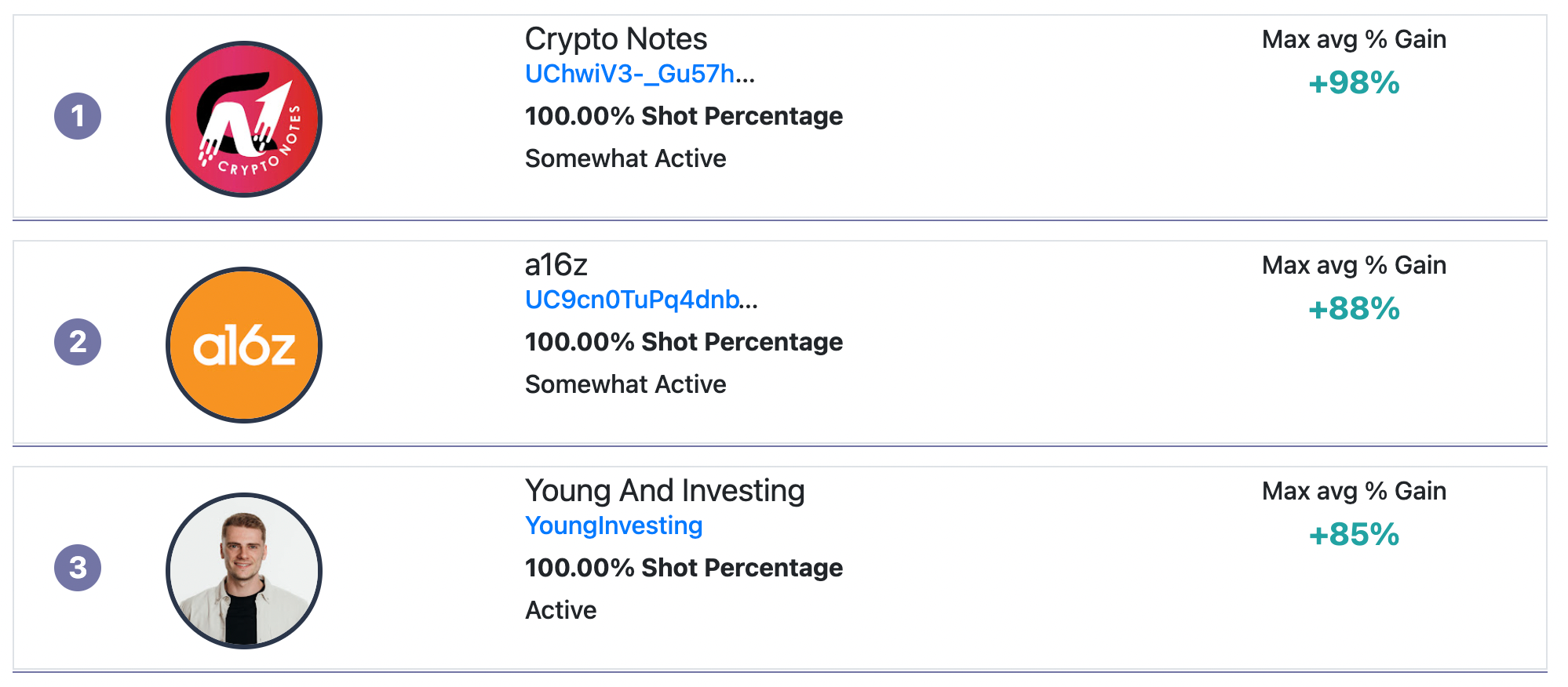

Which Shot Caller would have made you the most stacks on crypto lately?

These are some of the best financial influencers we have been tracking over the last two months. We look for influencers that have the pulse of the market by measuring ROI over 30 days. We ingest Youtube and Reddit and use AI to capture their predictions about the crypto markets.

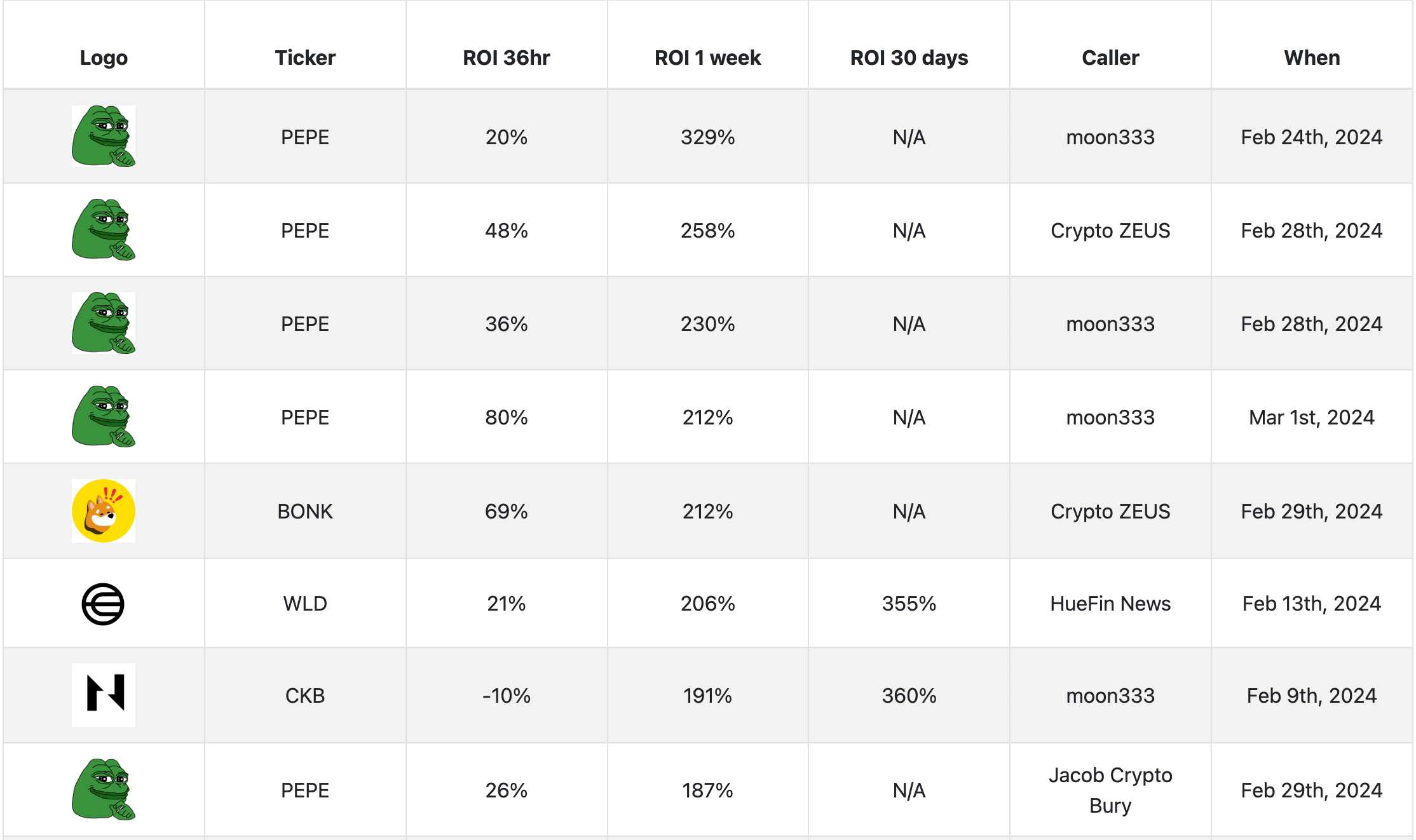

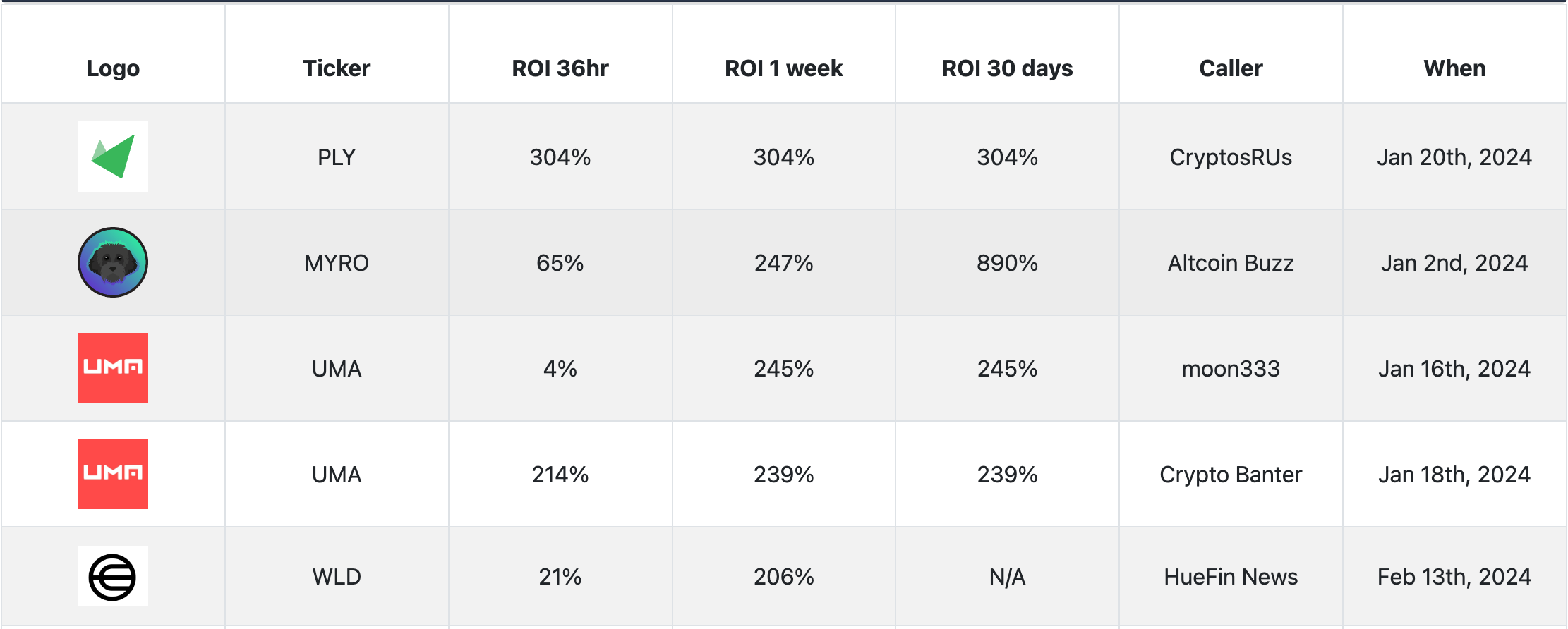

The best recent shots called

The degens dominated the February charts. The YouTube influencers in our database that had a grip on the pulse of the meme market offered some of the best possible gains.

The month prior was more balanced, the best shots were found in different ecosystems.

I was curious so..

I was curious about how these fellow degens were making the case for meme tokens like PEPE and BONK so I ran portions of the transcripts through an LLM to get a summary. Here they are:

PEPE Breakout: Recently broke out of a downtrend channel on the daily chart, signaling potential bullish momentum.Resistance Challenges: Despite breakout, PEPE faced multiple rejections at a new downtrend line resistance, indicating strong overhead pressure.Key Resistance Zone: Aiming to surpass a critical long-term resistance zone ranging between $1.36 and $1.46, previously acting as both strong support and resistance.Potential for Upside: Successfully breaking this resistance could lead to a significant rally, with the immediate target being the previous channel top around $1.77.Historical Patterns: PEPE has shown patterns of rallying after breakouts, such as a 55% pump following a harmonic bullish reversal signal shared with members in February 2024.Trading Signal Success: Recent trade signals, including channel breakouts and harmonic patterns, have led to profitable rallies, suggesting close monitoring for upcoming signals could be beneficial.Long-Term Outlook: If PEPE overcomes the $1.36-$1.46 resistance, the next major target could be the long-standing resistance at $1.90, with current momentum indicating this is within reach.

Solana-Based Meme Coin: BONK is experiencing parabolic growth, benefiting from overall bullishness in the crypto market.Market Performance: With a market cap of $833.57 million and strong trading volume, BONK shows resilience despite corrections.Community and Exchange Support: Boasting 200k followers, 600k+ unique holders, and listings on 42 exchanges, BONK demonstrates robust community and market support.Recent Pump: BONK has surged 30% in the past 7 days, bouncing back from a critical support level.Technical Outlook: Despite a potential bearish pattern, BONK's recovery from significant support levels suggests bullish sentiment. A 168% increase is needed to revisit all-time highs, indicating substantial upside potential.Risk and Potential: While volatility is inherent, especially in meme coins, BONK's substantial market cap and exchange listings offer a foundation for potential future gains.

I put a couple more together for PLY and MYRO here.

When to take profits?

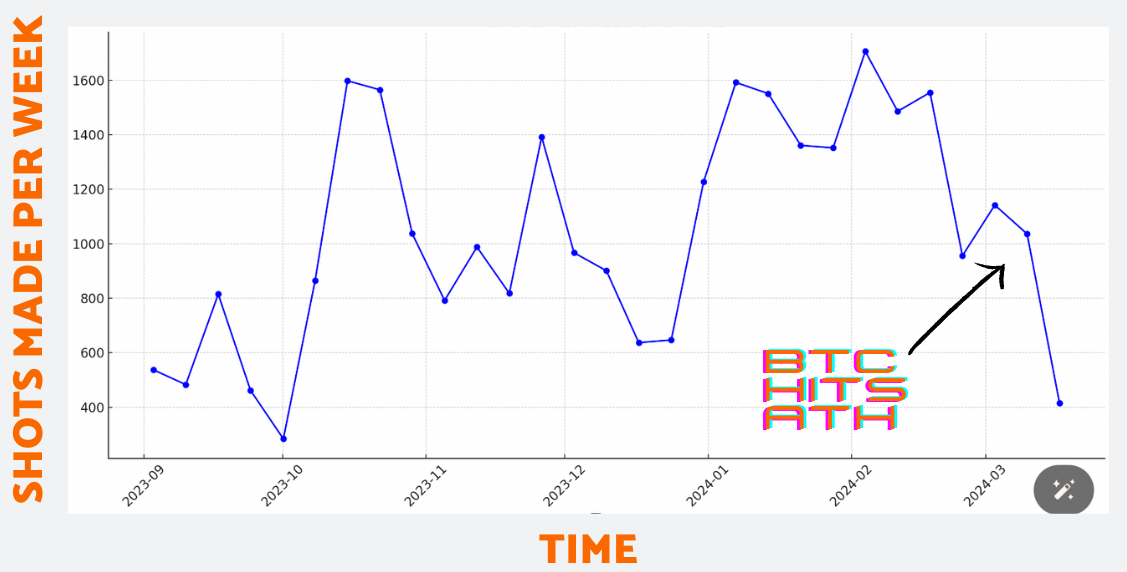

Something interesting emerged in the aggregate data that could assist us in determining when to take profits. We are specifically examining the trend of what we call ‘shots’ on YouTube over time.

One might anticipate a continuous increase in shots until reaching an all-time high (ATH), followed by a decline. Typically, influencers might intensively share these shots until the market corrects. However, contrary to this expectation, we observe a significant decrease in the volume of shots in the weeks leading up to the ATH of Bitcoin ($BTC).

A decrease in shot volume could indicate a lack of confidence in the market among savvy player, at least in the short term. Even though influencers may not explicitly advise selling, their hesitance in making any recommendations at all could be tipping their hand (a set of bears). If this scenario holds true, it would not be surprising. Influencers often face criticism for spreading (FUD), leading them to choose silence instead.

The coming week(s)

The general sentiment is mixed right now for the short term outlook. Lots of Shot Callers have entries during the bear market and are now up anywhere from 300% – 1000% (without leverage) so it is natural we are in a profit taking season.

However, there is pretty wide consensus that this bull run is not over and in the coming weeks/months it is time to look for overlooked ecosystems and narratives and good re-entries points on ones that have already pumped.

The Shot Caller meter has been slightly trending down.

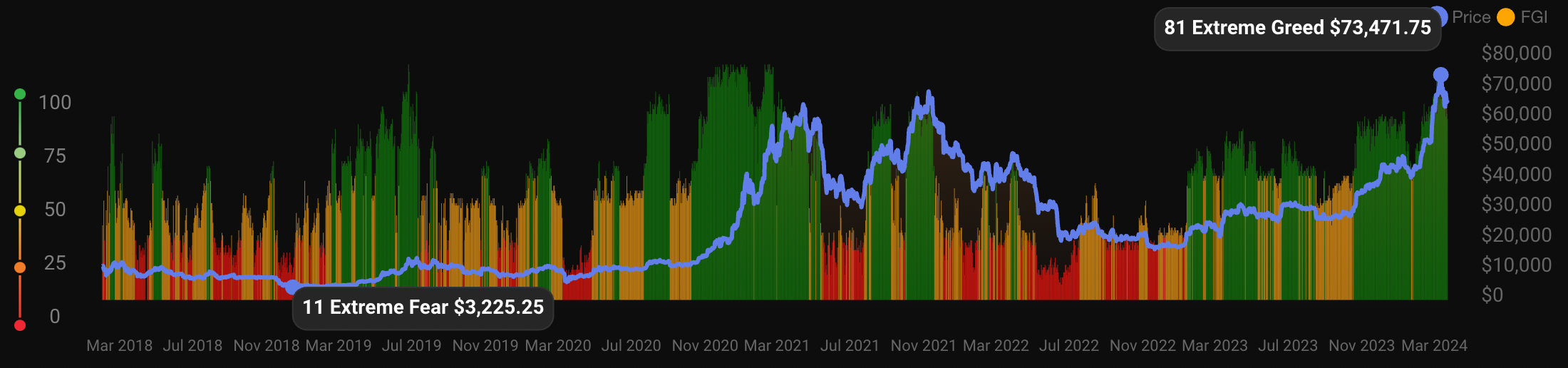

The Fear/Greed index from alternative.me is also backing off from near extreme greed levels (top). Mapping the Fear/Greed to BTC price from CoinStats(bottom)

Fresh Shots

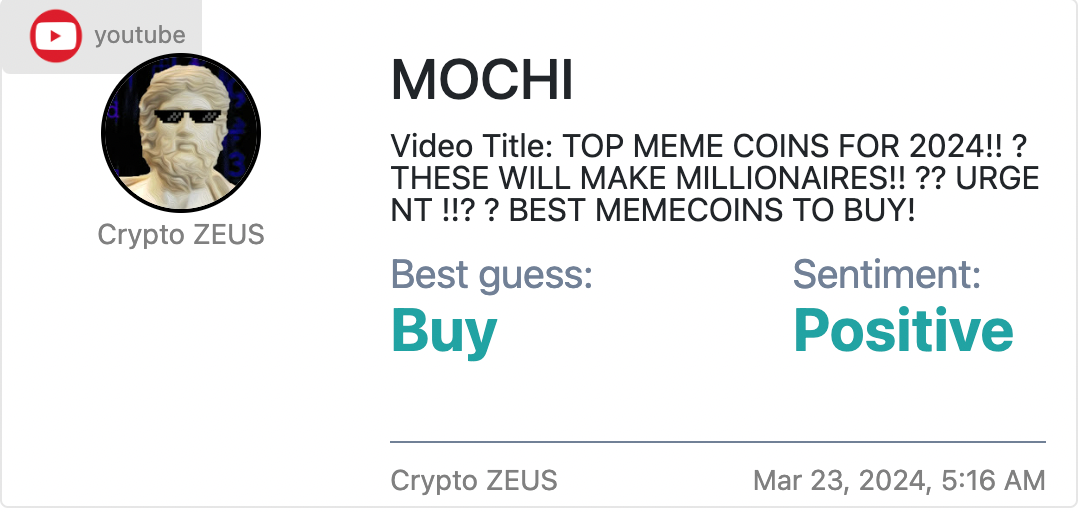

Here are a few shots that have been this week from Shot Callers that on the top of the rankings. I’m picking ones that have made any big moves recently. These are more like degen bets so obviously not financial advice.

See you next week

We are still in BETA so send any questions, feedback, suggestions our way DM at https://twitter.com/ShotCallerAI or email me.

-Shot Caller Team